The pair remains overbought according to CFTC positioning data (+23% of open interest), but there are clear indications that the process of adding EUR longs/building USD net shorts has stalled again in July.Īll in all, it appears that EUR/USD has managed to navigate the worst (barring new volatility peaks) of the US bond sell-off relatively easily, a sign that markets remain reluctant to let go of a cyclical currency like the euro in the current market environment (despite a deteriorating outlook for the eurozone economy) and the room for a big dollar recovery remains still narrow given markets now expect the Fed to be done with monetary tightening. Still, we expect some consolidation of the dollar around current levels into Thursday’s inflation numbers.Īccording to our short-term fair value model, EUR/USD’s equilibrium level currently sits around 1.0950, quite close to spot. At this stage, it would probably take a larger swing in yields to cause a substantial spill-over into FX than it did before the US credit downgrade by Fitch. With the exception of the yen, it appears that most G10 currencies are losing their direct exposure to swings in US bond yields. It will be interesting to hear what FOMC members Patrick Harker and Thomas Barkin say about the economy in two separate speeches today, especially following last week’s slightly weaker-than-expected headline payroll figures. Today, the key highlights are the NFIB Small Business Confidence Optimism Index – which is expected to rise very marginally from June – trade balance figures from June, and final wholesale inventory numbers. The US data calendar only includes second-tier releases until Thursday’s CPI figures. With the Bank of Japan normalisation still looking too remote to temper bearish pressure on the yen, USD/JPY is the most exposed G10 pair to the ongoing bond market instability, especially given some signs of resilience in US equities, which limited losses in high-beta currencies. We continue to observe rather elevated volatility in bond markets, with long-dated Treasury yields rising again: unsurprisingly, the only notable move in FX since the weekend has been another leg higher in USD/JPY. Treasury provides historical data back to 2000.It’s been a slow start to the week in the currency market, with the dollar being mixed but generally supported yesterday and in today’s Asian session.

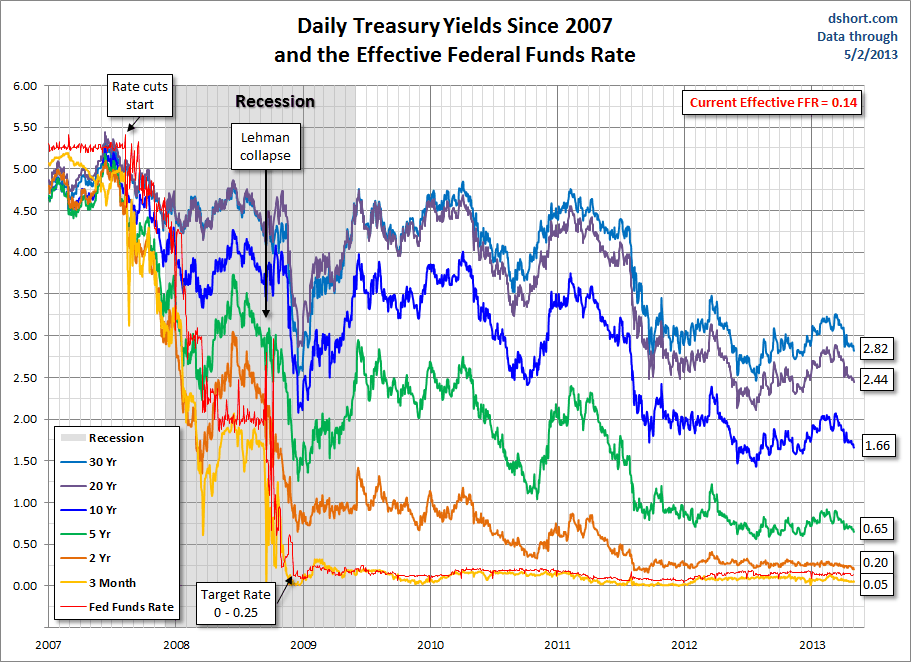

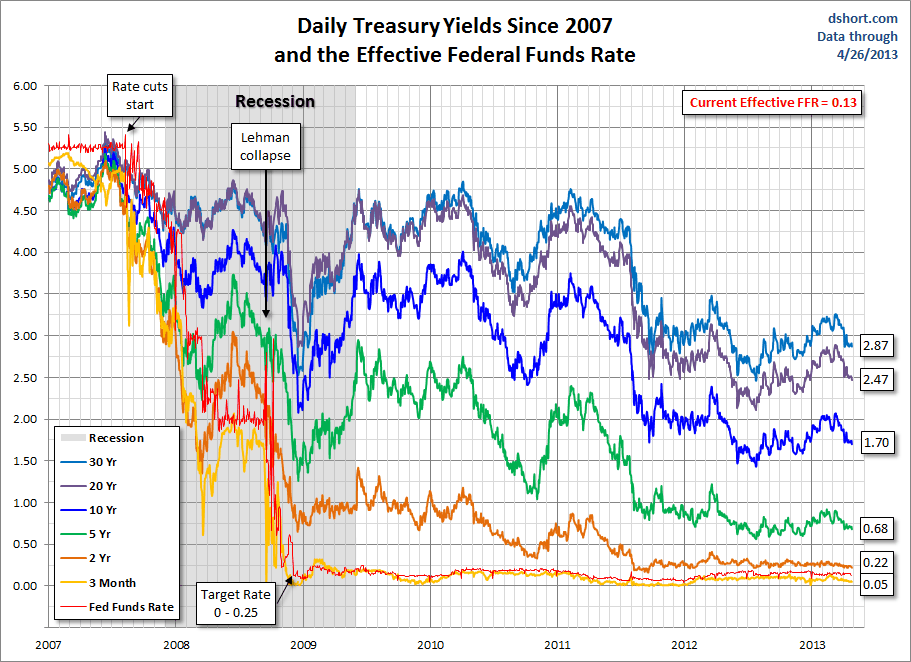

Daily treasury yield series#

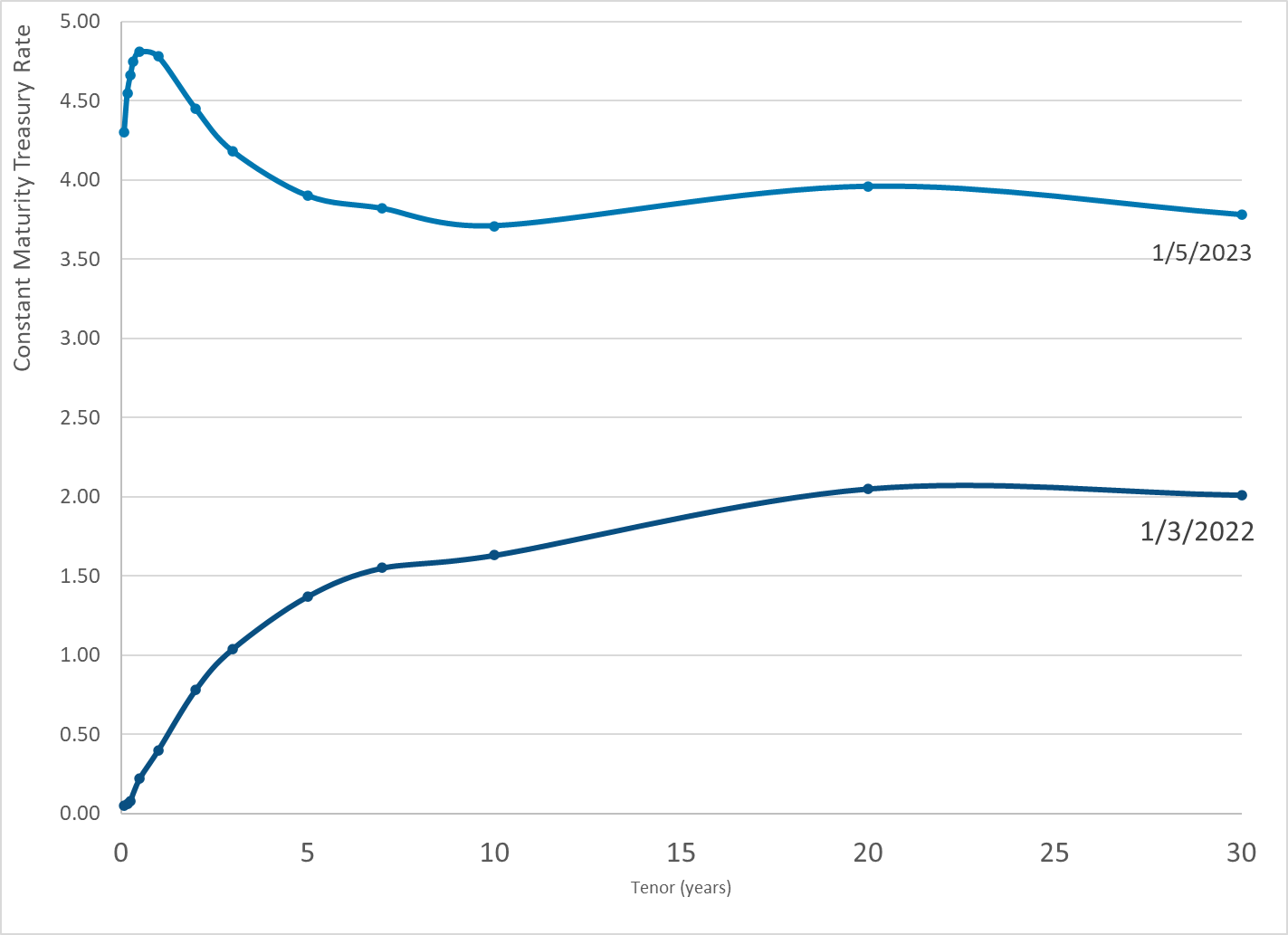

This series is intended for use as a proxy for long-term real rates. View the Daily Treasury Long-Term Rates and Extrapolation Factorsĭaily Treasury Real Long-Term Rate Averagesīeginning on January 2, 2004, Treasury began publishing a Long-Term Real Rate Average. Detailed information is provided with the data To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Treasury ceased publication of the 30-year constant maturity series on Februand resumed that series on February 9, 2006.

These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day.ĭaily Treasury Long-Term Rates and Extrapolation Factors

View the Daily Treasury Par Real Yield Curve Rates At that time Treasury released 1 year of historical data. Treasury began publishing this series on January 2, 2004. The par real yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. The par real curve, which relates the par real yield on a Treasury Inflation Protected Security (TIPS) to its time to maturity, is based on the closing market bid prices on the most recently auctioned TIPS in the over-the-counter market. View the Daily Treasury Par Yield Curve Ratesĭaily Treasury PAR Real Yield Curve Rates For information on how the Treasury’s yield curve is derived, visit our Treasury Yield Curve Methodology page. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market.

NOTICE: See Developer Notice on changes to the XML data feeds.

0 kommentar(er)

0 kommentar(er)